Part 2: Pathways for action

This insight brief is the second in a two-part series exploring the topic of demand aggregation for zero-emission shipping fuels and the role it can play in supporting their early uptake in the sector. It surveys the available approaches to aggregating demand for zero-emission fuels in shipping and provides considerations for how they can be applied by early movers.

The first insight brief, outlining the nature and potential role of demand aggregation for zero-emission shipping fuels, can be found here.

Background and introduction

Following several years of industry action, the key elements necessary to kickstart the transition to zero-emission shipping are now coming into place.

Nearly 300 vessels capable of operating on methanol and ammonia will hit the water in the next few years, with more expected to follow. Meanwhile green methanol and ammonia projects with the potential to supply tens of millions of tonnes of zero-emission fuel this decade are under development.

Yet only a handful of shipowners and operators have so far secured the fuels.

The substantial cost gap between conventional fuel and green methanol and ammonia is the biggest blocker to the uptake of these alternative fuels within shipping. However, it is not the only factor; as argued in the first insight brief in this series, there is also a mismatch between what zero-emission fuel producers need to kickstart production projects and what shipping companies are currently willing or able to commit to. Aggregating demand for green methanol and ammonia represents a promising way to help tackle this mismatch.

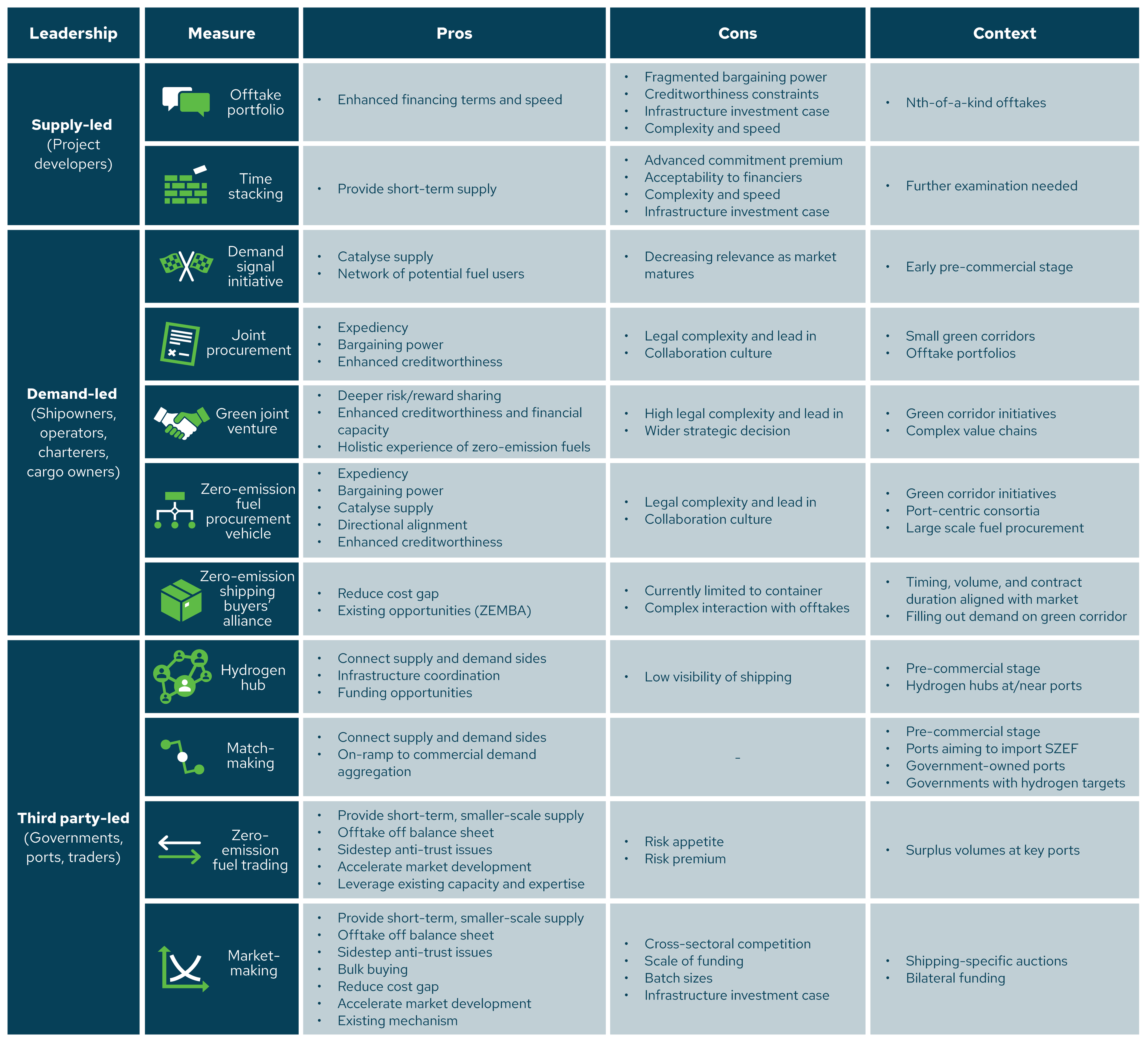

With almost a dozen separate approaches identifiable, there are opportunities for multiple actors within and beyond shipping to support fuel demand aggregation. To help early movers understand the options at their disposal, this insight brief surveys these approaches and provides an overview of key considerations surrounding them. With demand aggregation being an evolving landscape, it is not intended to be an exhaustive presentation, but rather to serve as a starting point for further discussion on the topic.

The recommendations in this brief should not be taken as legal or commercial advice.

Exploring zero-emission fuel demand aggregation measures

Securing zero-emission fuel is a process, and different shipping companies can be found at different stages. This suggests there is potential for demand aggregation not just at the point of procurement, but also in the stages before. As such, a distinction can be drawn between pre-commercial and commercial fuel demand aggregation measures. While commercial measures provide vehicles and mechanisms for aggregated purchases of zero-emission fuel, pre-commercial measures lay the groundwork for aggregated purchasing by engaging the supply-side and/or bringing together stakeholders to create networks capable of collaborative action.

Pre-commercial measures

Three main pre-commercial fuel demand aggregation measures can be identified: shipping companies can coalesce around sending demand signals, while third parties can engage in matchmaking exercises or facilitate the creation of hydrogen hubs.

Demand signal initiatives

Demand signal initiatives involve groups of shipowners, charterers and/or cargo owners communicating an intention to use zero-emission fuel or ships, with the aim of creating a “buzz” among fuel producers, the bunkering ecosystem, and governments. This can help direct fuel producers’ interest and planning towards the maritime market and/or stimulate dialogue between the hydrogen ecosystem, national policymakers and shipping around the infrastructure and policy enablers required for the uptake of zero-emission fuel.

Two demand signal initiatives currently exist in the shipping sector: the First Movers Coalition and the Cargo Owners for Zero-Emission Vessels (coZEV) 2040 Ambition Statement, both launched in late 2021. Meanwhile several of the most advanced green shipping corridor initiatives have established targets for zero-emission fuel uptake and/or estimates of the potential demand for zero-emission fuel on the route,1 which can be seen as location-specific demand signals.

These initiatives have the greatest impact on the zero-emission fuel market under conditions of technology and regulatory uncertainty, making them an early pre-commercial intervention.

Matchmaking

Matchmaking efforts involve a third party connecting potential buyers and sellers of zero-emission fuel. In the case of shipping, both government and ports are well-positioned to serve as matchmakers, as neutral actors with visibility over the supply and demand sides, including both shipping and land-side sectors.

Matchmaking efforts can be more or less structured, ranging from convenings to online platforms and targeted exercises. They have the highest potential where they provide an on-ramp for commercial demand aggregation.

Governments may create online platforms to support matchmaking. In June 2024, the EU announced a so-called Pilot Hydrogen Mechanism intended to “help scale-up EU hydrogen […] market development by […] helping buyers and suppliers connect”. Building on the example of the AggregateEU platform for gas demand pooling and joint purchases, the mechanism will “collect hydrogen demand from potential buyers and offers from suppliers”, and support matchmaking between them.2 It is planned to launch in mid-2025.

As illustrated by the Maritime and Port Authority of Singapore,3 ports can undertake expression of interest (EOI) exercises for zero-emission fuels. Here, a port presents an estimate of the aggregated volume of zero-emission fuel expected to be needed at the port and invites potential suppliers to submit proposals about whether and how they could meet this volume. This provides a two-way signal, about potential offtake opportunities at the port, on the one hand, and the feasibility, cost, and interest of suppliers to meet demand at the port, on the other. In this way, EOIs can generate confidence in the market and facilitate planning, while making connections between buyers and sellers that lay the groundwork for future offtakes.

EOIs are likely to be valuable exercises for first-mover ports in general, but particularly those that will import green methanol or ammonia rather than leverage local production. Ports with strong connections to regional or national government may also have particularly good potential for EOIs, with the ability to galvanise greater participation and enable more effective coordination of demand across sectors.

Hydrogen hubs

Hydrogen hubs describe networks of hydrogen producers, consumers, and connective infrastructure in a specific location.

Participating in hydrogen hubs can connect shipping with other local actors and industries seeking to offtake hydrogen-based fuels, while helping to reduce infrastructure costs and uncertainties. This makes them in some ways similar to matchmaking efforts.

One difference, however, is the access to economic support they may afford. As highly visible, strategic initiatives, many governments are providing funding for hydrogen hubs. While this has so far mostly consisted of development and capital expenditure support, facing slow progress in activating demand for hydrogen, governments are increasingly exploring incentives for operational expenditure. These incentives would target the cost gap associated with the consumption of clean hydrogen in end-use sectors. Notably, the US is developing a mechanism of this type connected to its seven hydrogen hubs. In January 2024, the US Department of Energy appointed a consortium to design the scheme, which has been allocated up to $1 billion in funding, with Contracts for Difference, a fixed premium, or market maker mechanism all being considered as potential design options.4

Shipping has not yet played an active role in hydrogen hubs, with, for example, just one of the seven US hubs focusing on marine fuels or bunkering.5 This suggests there may be opportunities for greater involvement by the sector in these initiatives.

Commercial measures

Commercial demand aggregation measures can be led by actors across the shipping value chain and beyond. Three groups of measures can be identified: a) supply-led measures, undertaken by fuel producers; b) demand-led measures, headed by shipowners, charterers, and cargo owners; and c) third party-led measures, spearheaded by ports, traders, international institutions or governments.

Supply-led

Fuel producers may support the aggregation of demand for zero-emission fuel in shipping through either offtake portfolio or “time stacking” efforts.

Offtake portfolio

An offtake portfolio effort describes an effort by a project developer to build a portfolio of offtakes sufficient to take final investment decision (FID) on a fuel project. This involves engaging possible customers from target end-use sectors, negotiating with interested parties, and aligning the offtakes into a viable portfolio. These activities represent common practice for project developers and are already happening today.

Figure 1: Schematic of an offtake portfolio effort

As outlined in the first insight brief, project developers are seeking several offtake agreements, preferably from different sectors, to take FID on large-scale green methanol and ammonia projects. In this context, offtake portfolio efforts are likely to play an important role in aggregating demand for zero-emission fuels, by integrating demand across sectors in a way required for an FID.

These efforts could present some benefits relative to other commercial demand aggregation measures; they may, for example, facilitate closer discussion with financiers during the offtake negotiation, which could help reduce the resource-intensiveness and accelerate the process, while generating cost benefits that could flow through to the offtakers. They are, however, also subject to several limitations:

Financial and logistics challenges: The full offtake would remain on shipping companies’ balance sheets; as such, some form of credit enhancement or guarantees may be required for smaller shipping players to secure supply. Meanwhile, offtakers will not necessarily seek delivery of the fuel to the same location. This could make new infrastructure investments more difficult. A case may need to be made for the fuel to be delivered to the same bunkering location. Otherwise, bunkering may need to take place in one of today’s major bunkering hubs, which are likely to be the preferred point of delivery for many early movers in the sector.

Complexity: Aligning multiple actors from different sectors (with differing willingness to pay and operational models) is likely to be more complex and time-consuming than negotiating with aggregated sources of demand.

Bargaining power and scale: Buyers’ bargaining power is fragmented, which may lead to less favourable offtake terms than demand-led aggregation.

These factors may limit the relevance of offtake portfolio efforts until the zero-emission fuel market reaches a greater level of maturity.

Time stacking

More innovative approaches are also being considered by fuel project developers. One such idea is “time stacking”.

Time stacking involves a fuel producer splitting the conventional 10-to-15-year offtake commitment needed to kickstart a fuel project into shorter tranches that can be signed by different offtakers. These tranches could, in theory, be equal length – e.g. a series of five two-year offtakes – or of different lengths – e.g. one “cornerstone” offtake covering the early period of the offtake and a series of smaller tranches covering the end. The fuel producer would then align or “stack” the tranches into a package covering the 10-to-15-year period. As such, it may be thought of as aggregation in time, rather than volume.

Figure 2: Schematic of time stacking mechanism

The major benefit of time stacking would be allowing shipping companies that may not have the risk appetite or balance sheet to sign a full 10 or 15-year offtake to secure a level of zero-emission fuel supply for their fleets.

Time stacking has not yet been put into practice and thus its real-world feasibility remains to be demonstrated. Several anticipated challenges would need to be overcome for it to be a solution in aggregating zero-emission fuel demand in shipping:

Advanced commitment: Aligning a sequence of buyers across a 10 to 15-year period is likely to be complex and require buyers willing to make purchase commitments up to a decade in advance. If the cost of the fuels declines over time, these commitments could be more expense than buying the fuel at the time of use.[JF16] Pricing adjustment mechanisms could mitigate this issue but may be unappealing to fuel project financiers.

Acceptability to financiers: An appropriate legal “wrapper” that would make the package acceptable to the fuel project's financiers would need to be found, including an approach to assigning credit risk between the different buyers.

Infrastructure investment: The short-term supply associated with time stacking may make investments in dual-fuel vessels and, particularly, methanol or ammonia bunkering infrastructure more difficult, unless the actors buying tranches committed to bunker at the same location and, ideally, to use the same bunker provider.

Demand-led

Perhaps the most obvious approach to aggregating demand for zero-emission fuels would be for groups of shipowners, operators, and/or charterers to come together and pool their individual demand. Indeed, collaborative action by shipping actors, as the users of the fuel, would present several advantages:

Expediency: The ability to leverage shipping actors’ existing relationships and understanding of the sector could allow the quick identification of possible collaborators and kickstart action.

Bargaining power: Bringing large bundles of demand to the market could give participating companies greater bargaining power, positioning them to negotiate favourable offtake terms.

Demand buzz: Bringing large bundles of demand to the market may make shipping as a whole more visible and attractive to zero-emission fuel producers.

Directional alignment: Acting in concert with counterparts in the sector would provide participating companies with a level of reassurance about their zero-emission fuel choices and early-mover status.

Creditworthiness: Smaller shipping companies could potentially benefit from the greater creditworthiness of their larger counterparts, broadening access to zero-emission fuel.

While examples exist in other sectors,6 demand-led fuel demand aggregation initiatives have yet to emerge in shipping. But some suggestions can be made about the main opportunities and challenges facing these efforts.

First, at this early stage in the development of the zero-emission fuel market, a global effort to secure fuel for participating companies’ fleets would be a major undertaking. In the near-term, demand-led initiatives may benefit from having a specific geographical focus. One possibility would be focusing on securing supply on a given green corridor. Another possibility would be for a group of stakeholders with a shared bunkering pattern to make zero-emission fuel available at a given bunkering port/ports. While green corridors may be most relevant in trades with more regular operational patterns – such as container shipping, ferries, and metal and ore trades – a port-centric approach may be more relevant to tramp shipping, which lacks predictable routes but will regularly stop to bunker at key bunkering hubs, making them a logical place to create supply.

Second, these initiatives could involve other sectors. Bulk shipping may be particularly well-placed to collaborate with other sectors, given the segment’s interface and relationships with the industrial economy. For other segments, this could be an area in which matchmaking or hydrogen hub efforts could be beneficial.

Third, in contrast to supply or third party-led aggregation, demand-led aggregation would involve direct collaboration between shipping companies. Given the commercially sensitive nature of fuel contracts and potential implications of action on freight costs, care will need to be taken to ensure the full compliance of these efforts with competition law, particularly where companies are competitors. Given its concentration and higher visibility, these issues may be particularly acute in container shipping; however, other concentrated markets, like iron ore shipping, could also be affected. The specific vehicle and mechanism by which demand is aggregated will be important in this regard. Several approaches are conceivable:

Joint zero-emission fuel procurement

One approach could be for interested members of a green corridor initiative or port-centric consortium to run a joint procurement for zero-emission fuel supply. This would involve a joint tender process for the quantity of fuel needed to meet collective corridor targets or combined demand for zero-emission fuel at the port in question.

Figure 3: Schematic of joint fuel procurement

Firewalls would need to be built into this process to prevent the exchange of sensitive information about fuel prices, particularly between competitors. This may mean a neutral third party managing the process or using a third-party procurement platform.

While there may be benefits in establishing a more formal structure for collaboration (see below) where multiple offtakes are needed, joint procurement could be a model for securing one-off zero-emission fuel supply. This could be relevant for green shipping corridors with lower amounts of traffic, where a single offtake would be sufficient to decarbonise the route’s fleet, or where shipping companies are taking a portfolio approach to zero-emission fuels, securing small scale supply of several different alternatives.

Zero-emission fuel procurement vehicle

Another approach would be to create a vehicle for joint procurement of zero-emission fuels. This could be an independent entity set up by the group of prospective buyers or by a neutral third party, such as a port, NGO, or international organisation.

Figure 4: Schematic of zero-emission fuel procurement vehicle

The vehicle could operate via a tender process, gathering indicative fuel requirements at given port(s), before putting the aggregated volume out to the market. The party managing the process would scrutinise the bids and recommend a winner to participants. They may then bilaterally sign agreements with the winning supplier. This approach - resembling the one used by the Zero-Emission Buyers Alliance initiative (see below) - could reduce the resource-intensiveness of the offtake negotiations both for suppliers and users through a single process managed by a third party, while ensuring compliance with competition law.

Participation in such tenders could be open to any actors interested in securing fuel on the route or at the ports in question. Indeed, this would help enable access to larger-scale projects, with resulting cost benefits. This could include cargo owners, which could provide cash to fund the offtakes as a pre-payment for zero-emission shipping services.

Since the tender would be focused on delivery to specific ports, this approach should not fragment demand for bunkering investments. It would, however, require participants to be sufficiently creditworthy to sign the offtake agreements, which may be a challenge for smaller players. It is conceivable that aggregating demand into a wider package, particularly one that includes commitments from larger, more creditworthy parties, may offset this. If not, these actors may need credit enhancement or guarantees to facilitate their participation; one possibility in this regard would be for investment or multilateral development banks to establish a facility with the entity to support these actors.

Green joint venture

A final option could be for interested parties to establish a joint venture to own and operate zero-emission vessels; this joint venture would procure fuel to meet its operational needs, effectively aggregating demand between the partners.

Figure 5: Schematic of joint venture for zero-emission fuel demand aggregation

Green joint ventures are not new in shipping, with several real-world examples emerging in recent years, including Skarv Shipping Solutions, and Viridis Bulk Carriers. There are also emerging examples of joint ventures connected to green corridors, with, for example, COSCO and Fortescue having recently agreed to explore jointly building and deploying green ammonia-fuelled vessels on the China-Australia iron ore shipping corridor.7

Benefits would include cost and risk sharing, and leveraging combined financial capacity, while generating holistic experience about ordering and operating green methanol or ammonia-powered vessels. This would represent a deeper form of collaboration than a joint procurement. At the same time, the joint venture would not necessarily need to be a “forever arrangement”, but could be time-limited, for example, covering just the offtake or ship amortisation period.

Such a joint venture could be either a horizontal collaboration, between shipowners or operators, or a vertical collaboration, between shipowners, operators, charterers, and even cargo owners.

A horizontal collaboration could take one of two forms - a corporate collaboration between competitors, similar to a shipping pool arrangement, or creating a new entity, positioned as a competitor of the “parent” companies. These variants would be subject to different competition requirements, and therefore be more or less complex to set up and manage. In general, a new entity is likely to take some time to get the necessary clearances - in the range of months to years - particularly if the parents are large players.

A vertical collaboration could be relevant in parts of shipping with high complexity, such as bulk. In bulk shipping, deploying a zero-emission vessel may involve a complex web of contracts, responsibilities and decisions, including a shipowner ordering the dual-fuel vessel, a charterer agreeing to hire the vessel and securing the zero-emission fuel, and a customer signing a long-term supply contract. A vertical joint venture could help align these different elements while providing a means of leveraging downstream demand.