Shell and Deloitte’s new report sets out the industry view on barriers to decarbonisation and identifies priority solutions for meeting the IMO’s GHG ambitions.

As the International Maritime Organization (IMO) restarts its committee work this week with a focus on efficiency measures ensuring progress towards greenhouse gas (GHG) reductions in the sector, a new report published today by Shell and Deloitte finds that 95% of senior shipping executives see decarbonisation as important or a top three priority for the industry.

Nearly 80% noted that its importance had increased significantly over the past 18 months. This finding demonstrates real optimism and support for progress at the IMO.

The report brings together findings from in-depth interviews with more than 80 senior shipping executives from organisations across Europe, North America, and Asia, representing customers, ship owners, operators, charterers, port authorities, regulators, technology providers, financiers, equipment manufacturers and bunker suppliers. It presents an industry view of the barriers to decarbonisation the industry faces, and the solutions that would enable it to meet the IMO’s ambition of reducing GHG emissions by at least 50% by 2050.

The results have been both encouraging and daunting.

Despite the research being carried out as COVID-19 spread around the world and the impact of travel restrictions and falls in demand were beginning to become clear, senior shipping executives remained willing and enthusiastic participants. They reported different drivers to decarbonise – in Europe executives felt a stronger social and regulatory incentive, and in Asia executives predominantly felt the incentive was coming from regulation. But in all regions, decarbonisation is on the agenda.

Throughout the interviews we asked participants what they saw as the major barriers to decarbonising shipping. Three factors emerged as key: a lack of market and customer demand; no technological alignment on what the new fuels would be; and a lack of harmonised regulatory incentives.

Despite concerns around the deadlock that these barriers can create, with little clarity on where to start and who should lead, there was enormous optimism in what we heard. There is a growing view that now is the time to act if the industry is to meet the IMO’s ambition. Shipping executives noted that to reach it, the first net-zero vessels will need to enter the global fleet by around 2030 – something that has also been recognised through the goals of the Getting to Zero Coalition. This creates a real sense of urgency.

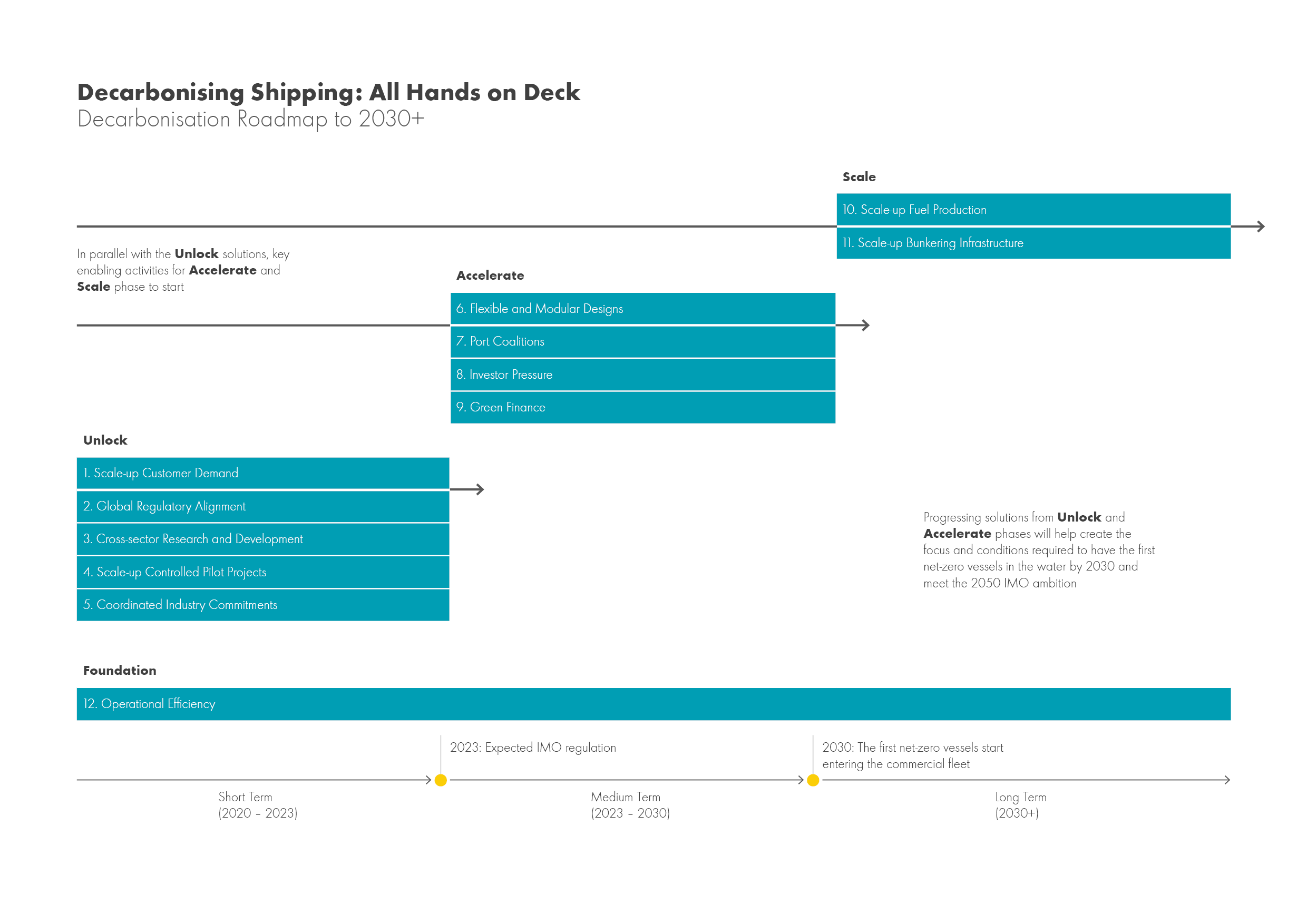

By recognising that all of us in the shipping industry were facing many of the same blockers, we were able to explore potential solutions, with different organisations contributing different pieces of the puzzle. Through this process, 12 solutions were identified with five of those prioritised as the most critical to unlocking progress in the short-term:

Scale-up customer demand:

Create scale in demand for low or zero-emission shipping through charterers’ and customers’ commitments that include long-term contracts and green procurement criteria. Natural candidates to lead this solution are state-owned and publicly listed companies with proximity to end consumers (e.g. containers, food bulk) and others with ambitious scope 2 and 3 net carbon footprint commitments.

Global regulatory alignment:

Create a level playing field globally and reduce uncertainty regarding regulations and timeframes. New IMO guidelines due in 2023 should provide clarity and should be aligned with leading local and regional regulatory bodies (eg. EU, China and US). Short-term regulatory incentives should also be considered.

Cross-sector research and development:

Intensify partnerships to develop zero or low-emission fuels through joint research and development (R&D) across shipping, other harder-to-abate sectors and the energy industry. Create a much larger pool of capital and expertise to evolve new technologies and increase the likelihood that production and transportation infrastructure will be available once future fuels are commercially viable.

Scale-up controlled pilot projects:

Increase R&D effectiveness by running end-to-end green pilot projects involving customers, charterers, operators, owners and ports on specific routes and vessel types. Operators that follow a predetermined schedule, such as container ships especially on shorter and busier routes, are likely candidates for pilot projects.

Coordinated industry commitments:

Increase the reach of existing initiatives – such as the Getting to Zero Coalition, Clean Cargo Working Group and others – by consolidating objectives and strengthening the coordination of various concurrent workstreams. A body with a specific mandate, formed with dues from the industry, could accelerate the shift from ideas to action and help break the deadlock.

Underpinning all of the solutions is operational efficiency. Particularly when the lifespan of a ship is 20-30 years, operational improvements to reduce the emissions of the current fleet are critical if we are going to meet the IMO’s ambitions for 2050. Whichever pathway to decarbonisation the sector chooses, efficiency is on the critical path to success. Which makes the talks this week all the more pressing.

But while efficiencies and the five priority solutions should unlock progress, they are only the first step on the road to net-zero emission vessels and decarbonisation. The industry identified a further six actions that will be needed to build on these between now and 2030.